dallas county texas sales tax rate

214 653-7811 Fax. This table shows the total sales tax rates for all cities and towns in Dallas County including all local taxes.

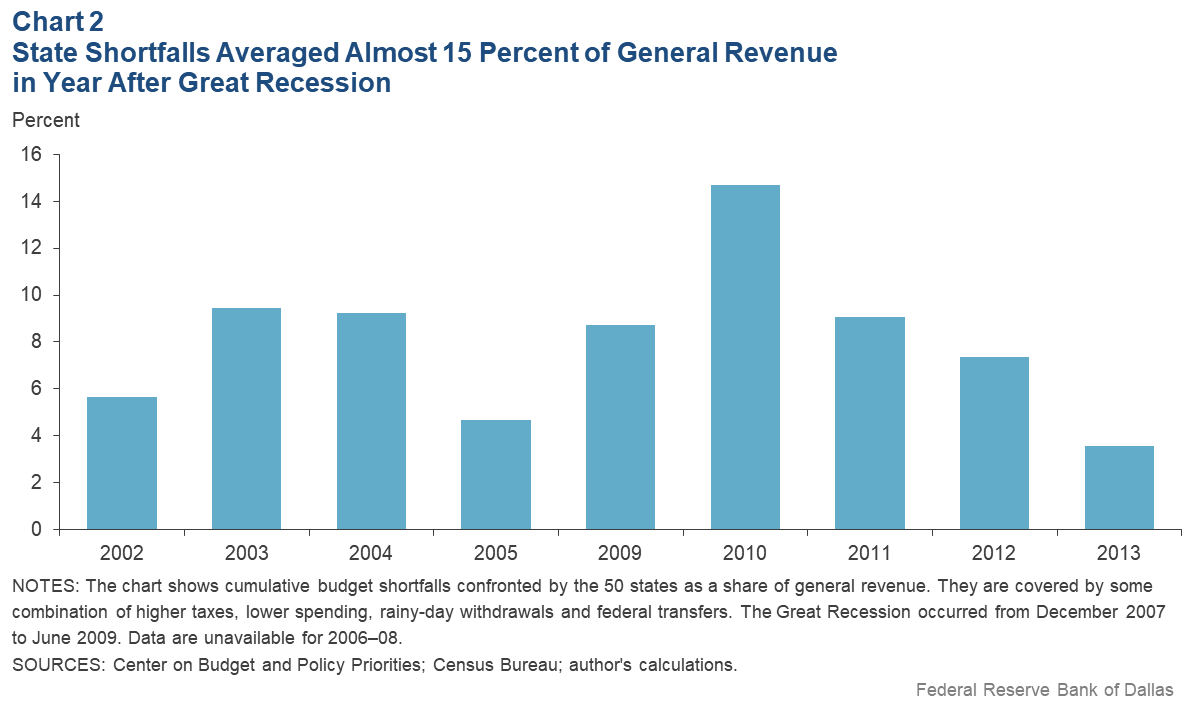

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

The Dallas Sales Tax is collected by the merchant on all qualifying sales made within Dallas.

. The minimum combined 2022 sales tax rate for Dallas Texas is. Has impacted many state nexus laws and sales tax collection requirements. 15 county tax rate.

214 653-7811 Fax. 60 Day Burn Ban in Effect as of June 23 2022. Dallas Texas sales tax is a rate of tax a consumer must pay when purchasing goods and some services in Collin Denton Kaufman and Rockwall counties Texas and that a business must collect from their customers.

4 1 county tax rate multiple county-wide SPDs. Fast Easy Tax Solutions. The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value.

The 825 sales tax rate in Dallas consists of 625 Texas state sales tax 1 Dallas tax and 1 Special tax. Texas has 2176 cities counties and special districts that collect a local sales tax in. While many other states allow counties and other localities to collect a local option sales tax Texas does not permit local sales taxes to be collected.

Automating sales tax compliance can help your business keep compliant with. 3 rows Dallas County TX Sales Tax Rate The current total local sales tax rate in Dallas. The County sales tax rate is.

TEXAS SALES AND USE TAX RATES July 2022. The Texas sales tax rate is currently. Dallas TX 75202 Telephone.

3 County has a county-wide SPD sales and use tax and an SPD sales and use tax in part of the county. 4 rows Dallas. For more information and registration please call 877 361-7325 or email.

The Texas state sales tax rate is currently. Dallas County is a county located in the US. Records Building 500 Elm Street Suite 3300 Dallas TX 75202.

34 rows Dallas County Has No County-Level Sales Tax. The Tax Office locations below are closed to the public on the following days. Downtown Branch Garland Branch and South Dallas Branch.

You can print a 825 sales tax table here. 2022 Tax Rates Estimated 2021 Tax Rates. Welcome to the Dallas County Tax Office.

Records Building 500 Elm Street Suite 3300 Dallas TX 75202. To review the rules in Texas visit our state-by-state guide. 625 percent of sales price minus any trade-in allowance.

Texas has a 625 sales tax and Dallas County collects an additional NA so the minimum sales tax rate in Dallas County is 625 not including any city or special district taxes. The base Dallas Texas sales tax rate is 1 and the Dallas Texas sales tax rate Dallas MTA Transit is 1 so when combined with the Texas sales tax rate of. As of the 2010 census the population was 2368139.

214 653-7811 Fax. 214 653-7888 Se Habla Español. While many counties do levy a countywide.

TX Sales Tax Rate. The Dallas sales tax rate is. 1 County-wide special purpose district SPD sales and use tax.

Name Local Code Local Rate TotalRate Name Local Code Local Rate TotalRate. The current total local sales tax rate in Dallas TX is. Tax Office Past Tax Rates.

The Dallas Texas sales tax is 625 the same as the Texas state sales tax. This is the total of state county and city sales tax rates. The Dallas County sales tax rate is.

Sheriffs Sales will be conducted monthly via an online auction. 214 653-7811. The Dallas Texas sales tax is 825 consisting of 625 Texas state sales tax and.

2 SPD sales and use tax in part of the county. The 2018 United States Supreme Court decision in South Dakota v. There is no applicable county tax.

Texas residents 625 percent of sales price less credit for sales or use taxes paid to other states when bringing a motor vehicle into Texas that was purchased in another state. Combined with the state sales tax the highest sales tax rate in Texas is 825 in the cities of Houston Dallas San Antonio Austin and Fort Worth and 105 other cities. Last updated August 2022 View County Sales Tax Rates.

There is no applicable county tax. Ad Find Out Sales Tax Rates For Free. Records Building 500 Elm Street Suite 1200 Dallas TX 75202.

AddisonDallas Co 2057217 010000 082500 Allentown 067500 DallasMTA 3057994 010000 AngelinaCo 4003007 005000 AdkinsBexar Co 082500 Alleyton 067500.

Which Texas Mega City Has Adopted The Highest Property Tax Rate

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

How To Charge Your Customers The Correct Sales Tax Rates

The Seller S Guide To Ecommerce Sales Tax Taxjar Developers

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

Tax Rates City Of Richardson Economic Development Department

How To Charge Your Customers The Correct Sales Tax Rates

How To Charge Your Customers The Correct Sales Tax Rates

Texas Sales Tax Rates By City County 2022

How To File And Pay Sales Tax In Texas Taxvalet

How To File And Pay Sales Tax In Texas Taxvalet

2021 2022 Tax Information Euless Tx

Texas Vehicle Sales Tax Fees Calculator Find The Best Car Price

Texas Sales Tax Guide For Businesses

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease