nanny tax calculator florida

Calculate pay and withholdings using The Nanny Tax Companys hourly nanny tax calculator or salary calculator. In this post you can find all the information you need in order to properly calculate your tax obligations to uncle Sam IRS as a newly household.

Nanny Tax Payroll Calculator Gtm Payroll Services

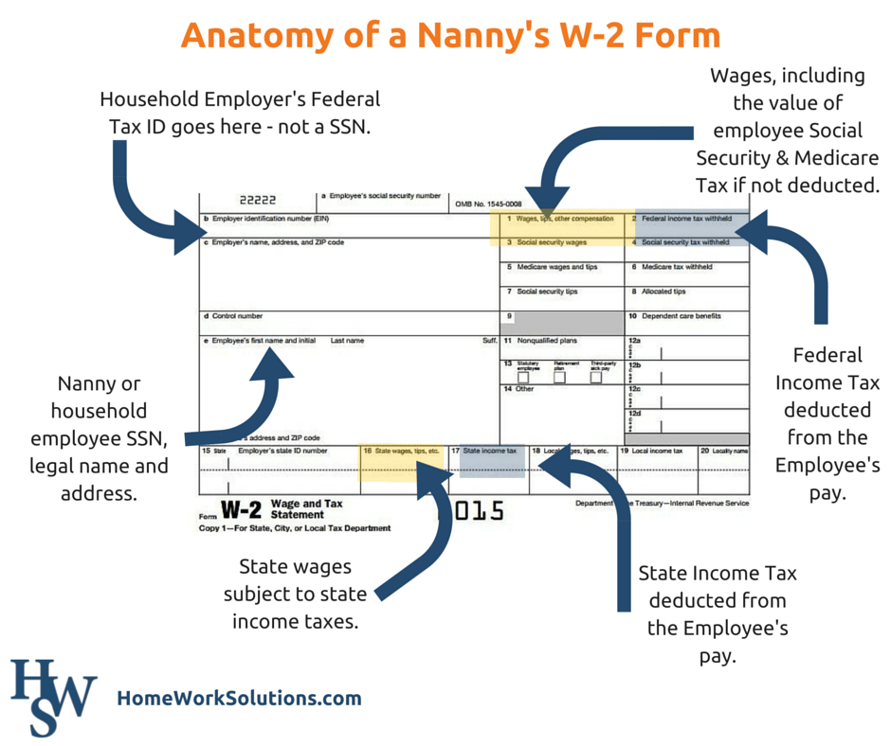

Youll need an employer identification number EIN if youre responsible for paying a nanny tax but this doesnt have to be a challenge.

. A millage rate is one tenth of a percent which equates to 1 in taxes for every 1000 in home value. 01500 State unemployment employee. GTM Can Help with Nanny Taxes in Florida.

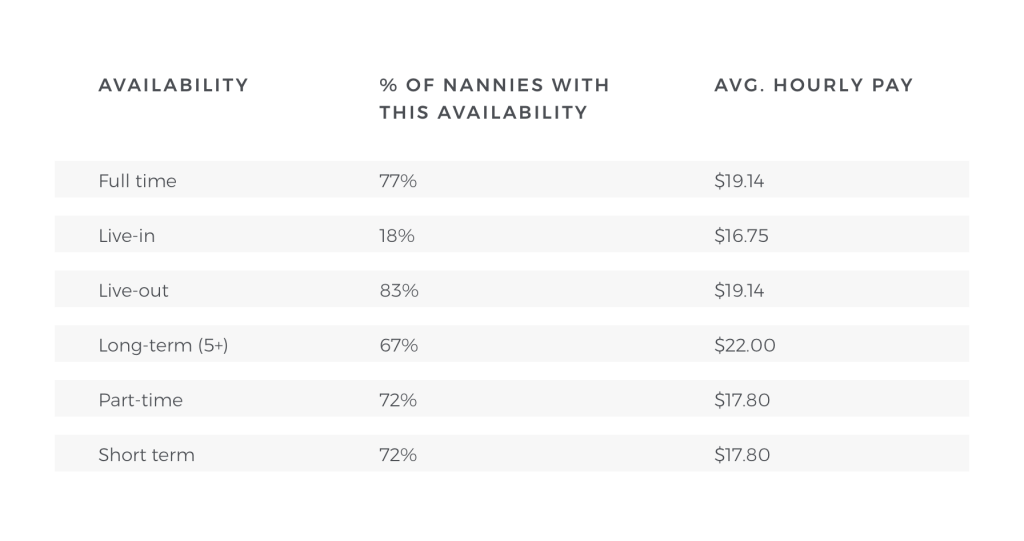

Nanny Tax Hourly Calculator. Employee State Tax Settings. 000070 State tax paid.

Florida Property Tax Rates. Cost Calculator for Nanny Employers. Searching for a Nanny Tax Calculator.

This is based on the 20222023 tax year using tax code 1257Lx and is relevant for the period up to and including 050722 this will be updated again. The amount of qualifying expenses increases from 3000 to 8000 for one qualifying person and from 6000 to 16000 for two. The penalty to the employer caught by an.

This calculator assumes that you pay the nanny for the full year. Using a calculator that is not current may cost you and your employee when filing tax returns and other reporting documents. Taxes Paid Filed - 100 Guarantee.

Well answer all your questions and show. 005000 Local tax paid. It is intended to provide general payroll estimates only.

File this application to establish a Reemployment Tax. Submitting your personal Federal income tax return and willfully failing to report and pay the household employment taxes is felony tax evasion. Florida defers to the FLSA which requires that all domestics excluding companions be paid at no less than the greater of the state or federal.

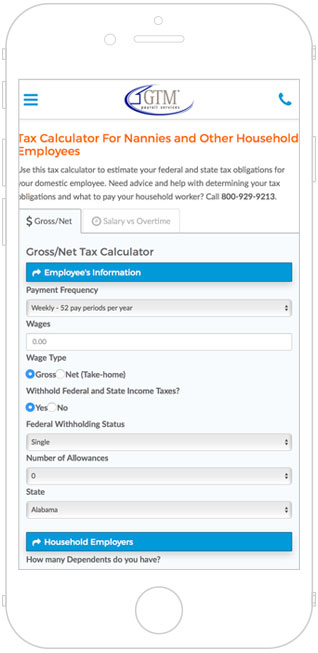

This calculator is intended to provide general payroll estimates only. Enter your employees information and click on the Calculate button at the bottom of the nanny tax calculator. The Nanny Tax Company has moved.

For tax year 2021 the taxes you file in 2022. If youre moving to Florida from a state that levies an income. Nanny tax rules household employment rules wage and hour law and payroll tax requirements are governed by a complex assortment of Federal state and local rules and legislation.

For specific advice and. FLORIDA LABOR LAWS Minimum Wage. How to File and Pay Nanny Taxes.

It is intended to provide general payroll estimates only. Gross vs Net Tax Calculator Employees Information Payment Frequency Weekly - 52 pay periods per year Bi-Weekly - 26 pay periods per year Semi-Monthly - 24 pay periods per year Monthly -. Our new address is 110R South.

For specific tax advice and guidance please call us toll free at 877-626-6924 and a NannyChex. Ad Payroll So Easy You Can Set It Up Run It Yourself. You can use our Florida Sales Tax Calculator to look up sales tax rates in Florida by address zip code.

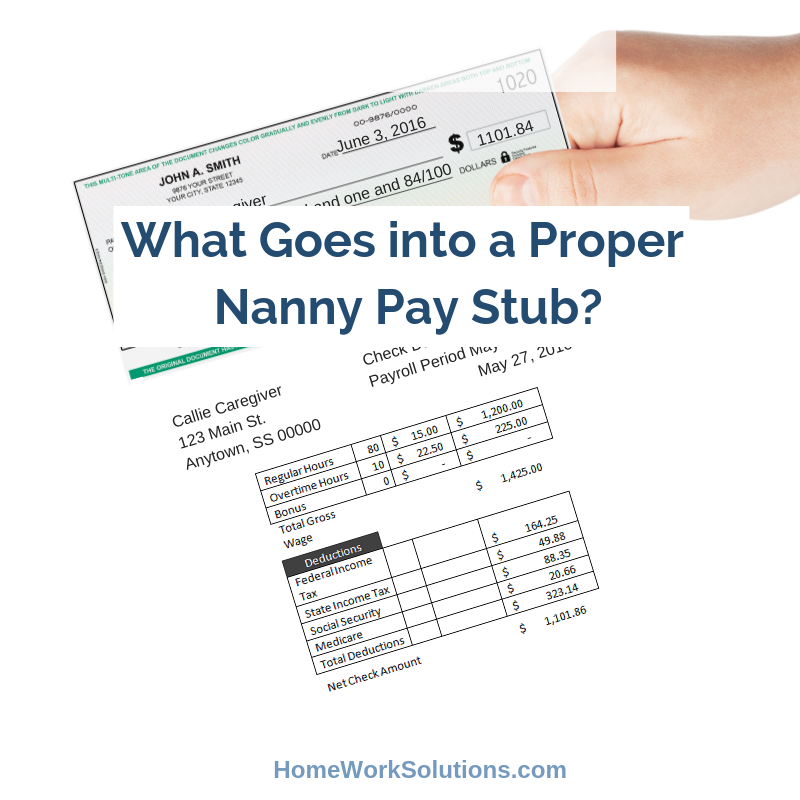

This is a sample calculation based on tax rates for common pay ranges and allowances. Please call us at 1-888-273-3356 or consult your tax. If you pay your nanny cash wages of 1000 or more in a calendar quarter or 2400 in a calendar year file Schedule H.

Federal tax paid. Call 800 929-9213 for a free no-obligation consultation with a household employment expert. Good news though NannyPay offers a low-cost and up-to-date.

The calculator will show you the total sales tax amount as well as the county city and. A nanny tax calculator will help you learn what your take-home pay will be when negotiating your pay rate. Social security nanny.

You can also print a pay stub once the pay has been. 002000 Extra per check. Your individual results may vary and your results should not be viewed as a.

Property taxes in Florida are implemented in millage rates. However in most situations you need to pay 06 for unemployment insurance for the first 7000 you pay your nanny.

Free Payroll Tax Calculator Paycheck Calculation Fingercheck

Nanny Tax Calculator Gtm Payroll Services Inc

Nanny Tax Payroll Calculator Gtm Payroll Services

Nanny Tax Calculator Gtm Payroll Services Inc

Nanny Tax Calculator Nanny Pay Calculator The Nanny Tax Company

A Nanny Asks Questions About Form W 2

Common Nanny Tax Questions Poppins Payroll

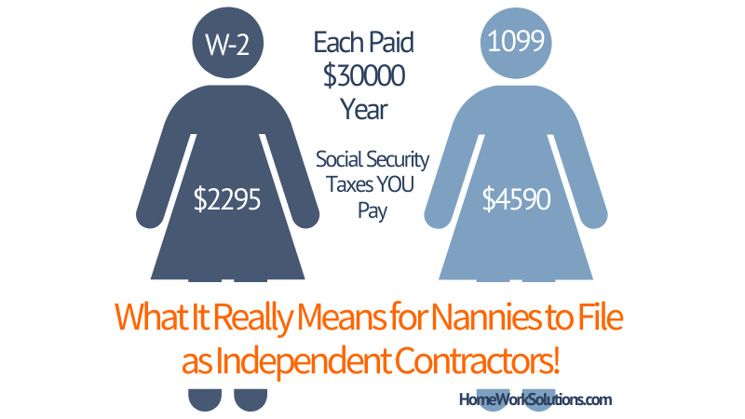

Babysitter Taxes Should A Nanny Get A 1099 Or W 2 H R Block

The Right Time To Put A Nanny Or Caregiver On The Books Hws

What Goes Into A Proper Nanny Pay Stub

I Never Got Around To Paying My 2016 Nanny Taxes Is It Too Late

How Does A Nanny File Taxes As An Independent Contractor

Full Service Nanny Tax Solution Poppins Payroll

.png?width=800&name=2017%20W-2%20FORM%20(2).png)

W 2 Reporting Required For Nanny Tax Free Healthcare Benefits

How To Pay Your Nanny S Taxes Yourself Nanny Tax Payroll Template Nanny Payroll

Nanny Tax Calculator Nanny Pay Calculator The Nanny Tax Company